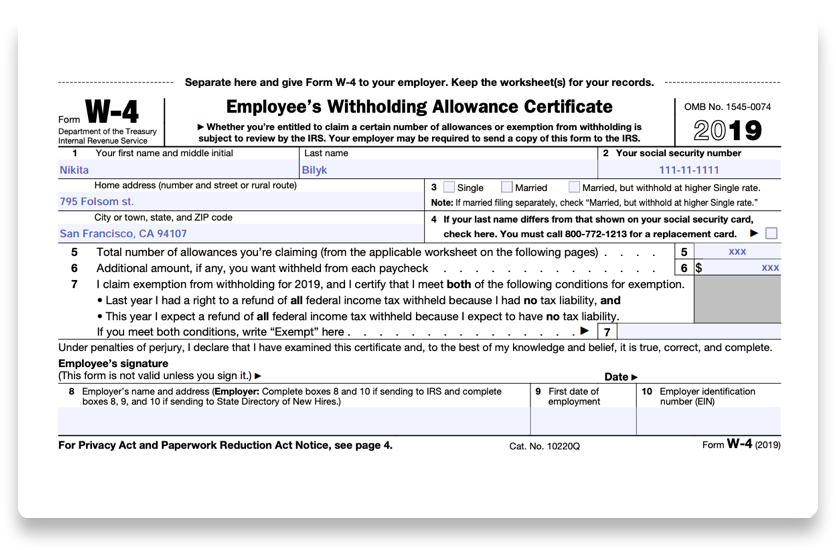

Printable W 4 Tax Form

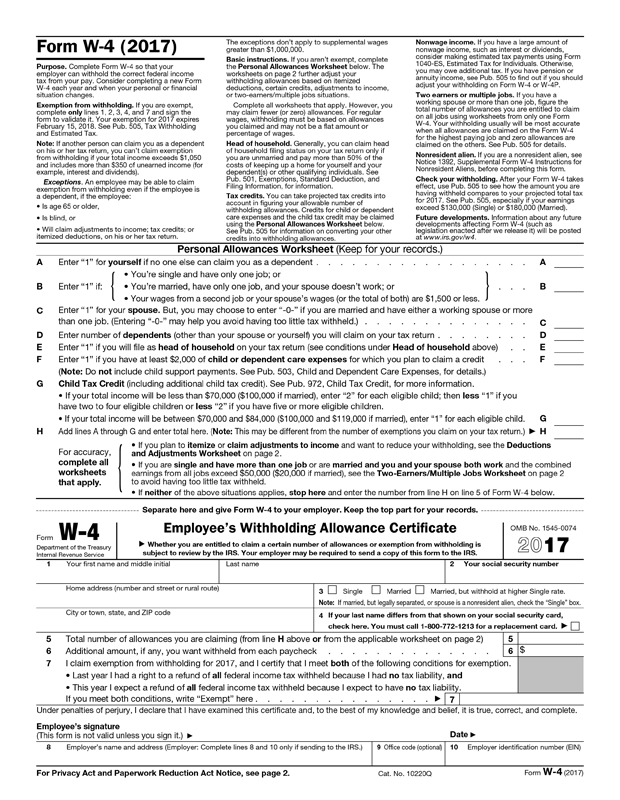

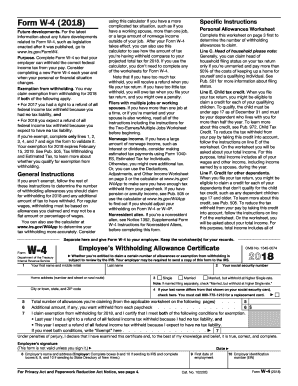

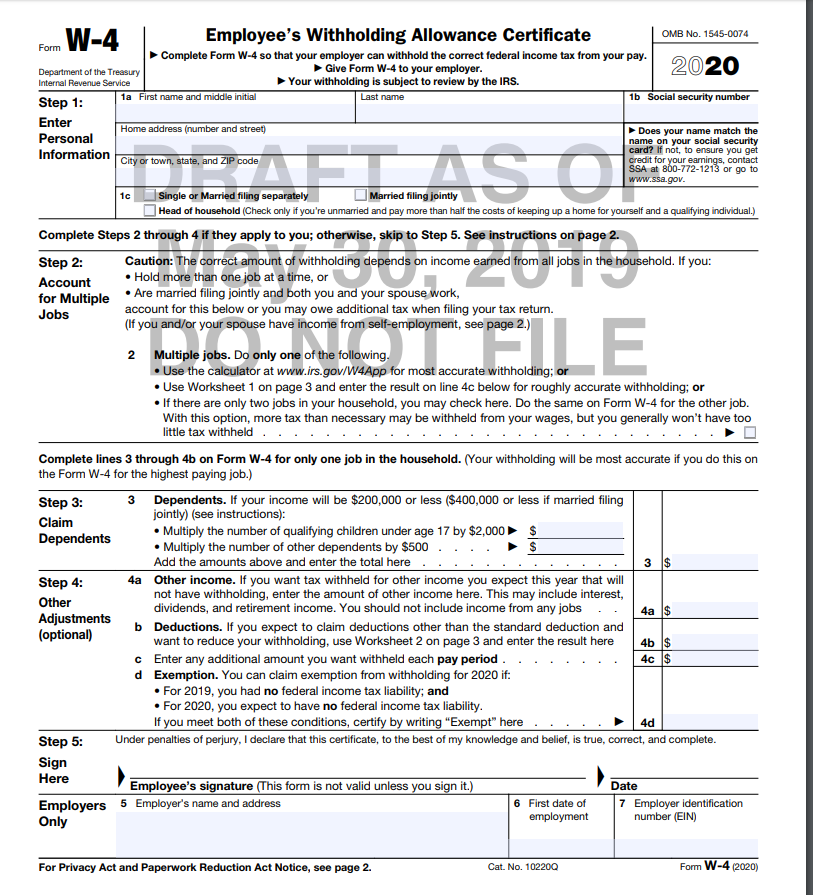

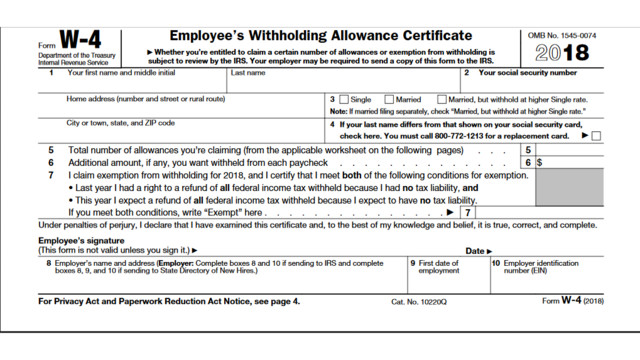

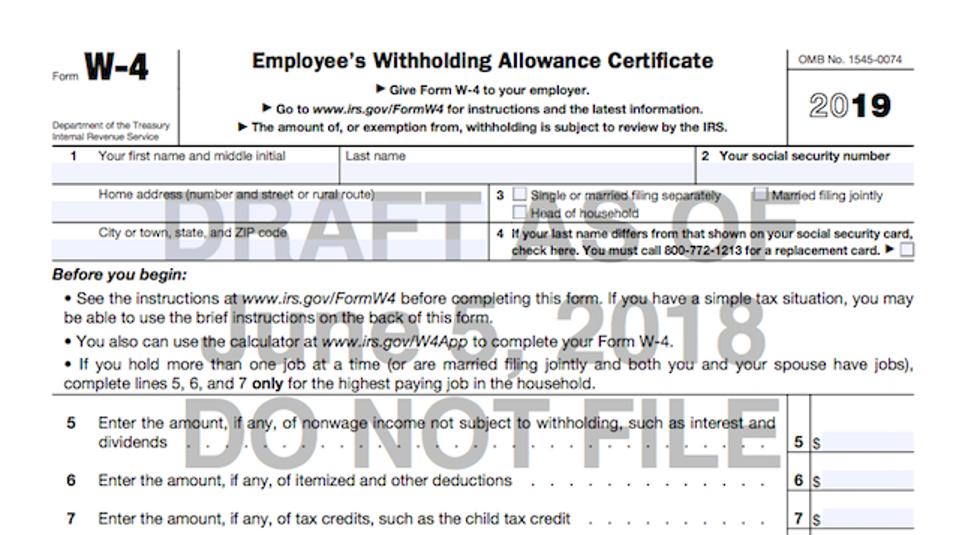

The redesigned form w 4 makes it easier for you to have your withholding match your tax liability.

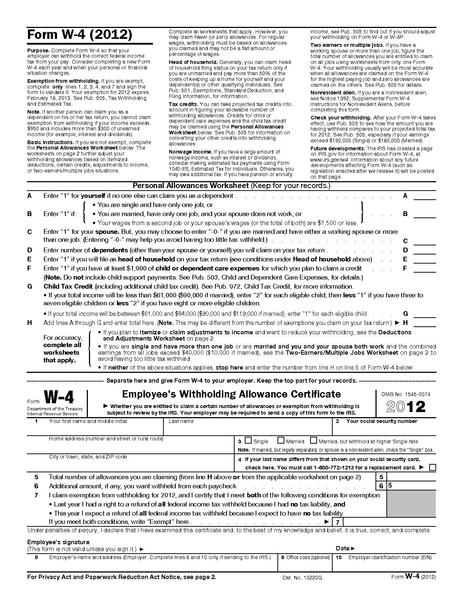

Printable w 4 tax form. But if you prefer to have more tax than necessary withheld from each paycheck you will get that money back as a refund when you file your tax return keep in mind though you do not earn interest on the amount you overpay. You may reduce the number of allowances or request that your employer withhold an additional amount from your pay which may help avoid having too little tax withheld. Complete form w 4 so that your employer can withhold the correct federal income tax from your pay. Printable irs tax forms can be downloaded using the links found below and used for tax filing purposes.

2 new printable irs 1040 tax forms schedules instructions. For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your form w 4 and your spouse should enter zero 0 on lines 5 and 6 of his or her form w 4. Step 3 of form w 4 provides instructions for determining the amount of the child tax credit and the credit for other dependents that you may be able to claim when you file your tax return. Complete steps 3 through 4b on only one form w 4.

Request for federal income tax withholding from sick pay 2019 01022019 form w 4v. Request for federal income tax withholding from sick pay 2018 01032019 form w 4s. Withholding certificate for pension or annuity payments 2018 02052019 form w 4s. Updated 5312019 the treasury department and the irs are working to incorporate changes into the form w 4 employees withholding allowance certificate for 2020.

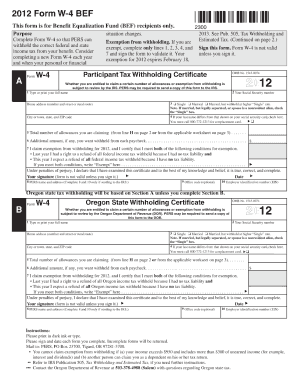

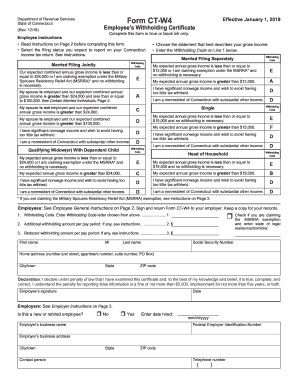

The current 2019 version of the form w 4 is similar to last years 2018 version. Forms w 4 filed for all other jobs. Form w 4 is an employees withholding allowance certificate which is filled in by an employee in order the correct federal income tax to be deducted from hisher payment. Keep this certificate with your records.

Form il w 4 for the highest paying job and claim zero on all of your other il w 4 forms. W 4 is usually filled out in the end of a year or when some changes occur in personal financial state. 3 old irs 1040 tax forms instructions. However theres a better way to get your tax forms.

If you have referred the employees federal.