Realtor Tax Deductions Worksheet

Real estate agent business expenses.

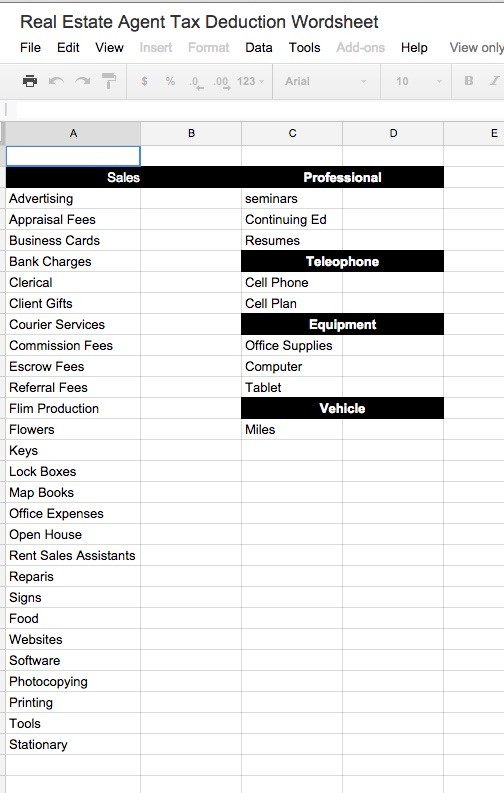

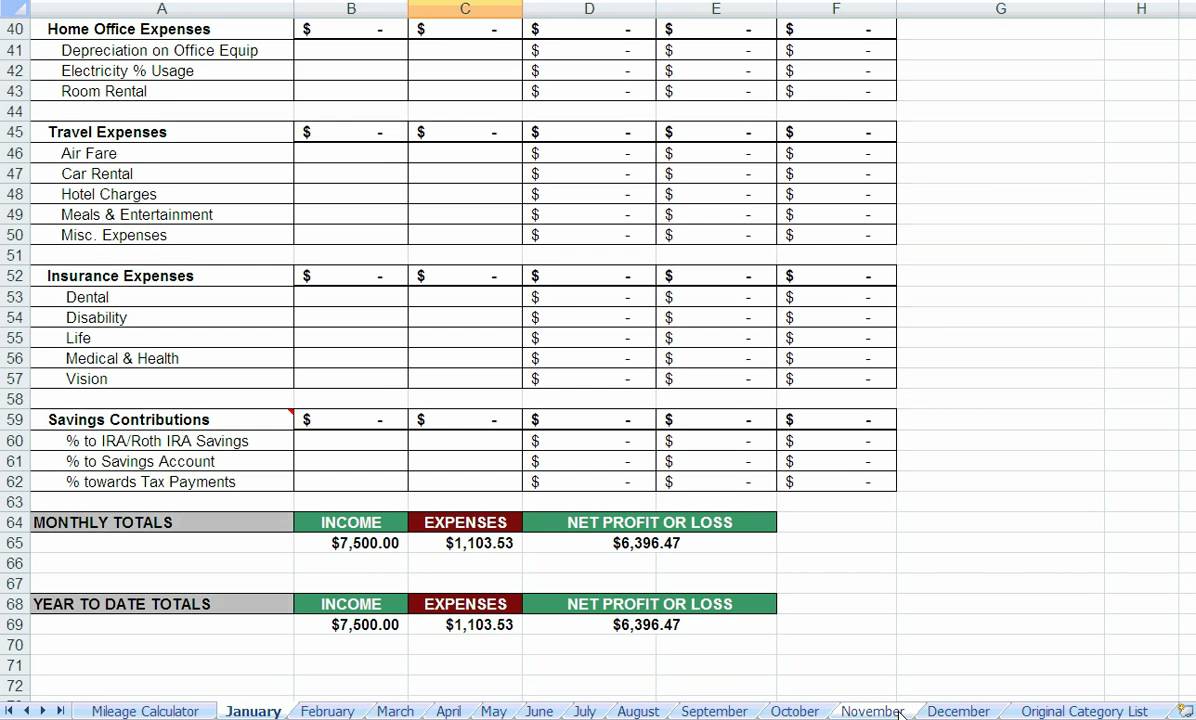

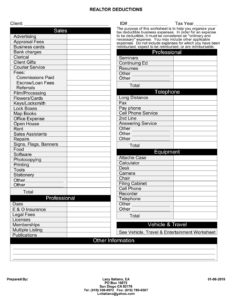

Realtor tax deductions worksheet. Office rental or co work space location rental when hosting events. Supplies expenses travel appraisal fees attorney fees bank charges business cards business meals enter 100 of expense. Expenses for your trips between home and. Tax deduction worksheet for realtors auto travel client meetings mi continuing education mi escrow loan office trips mi out of town business trips mi parking fees showing property mi tolls other.

Stats you didnt know the typical real estate agents business expenses during the year average 6500 while top performers expenses can exceed 10000. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible. If youre not tracking and deducting all of your eligible business expenses youre shrinking your net income and take home pay by paying too much in taxes. Showing top 8 worksheets in the category realtor deduction.

List of realtor tax deductions. It can get pretty overwhelming to keep track of so we have compiled a list of expenses that you will possibly incur throughout the year that can be tax deductible. Vehicle deductions for real estate agents. Professional dues and licenses like mls fees state licenses renewals professional memberships and membership fees to non profit organizations professional subscriptions.

Some of the worksheets displayed are realtors tax deductions work real estate agentbroker realtor deductions real estate income expense work rental property tax deduction work pre listing work rental property work 2018 tax rate and work layout 1. Listed below are our top 25 real estate agent tax deductions. We have created a checklist of our top 25 real estate agent tax deductions that you can download and use on your real estate agent tax deductions worksheet to ensure you dont miss out on any tax deductions.