Self Employed Receipt Book

Instructions for completing the self employment ledger template.

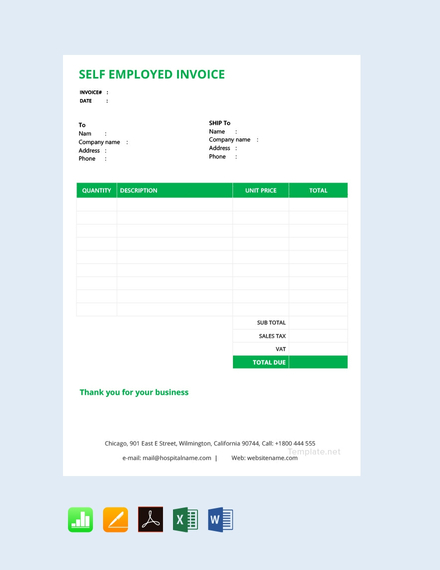

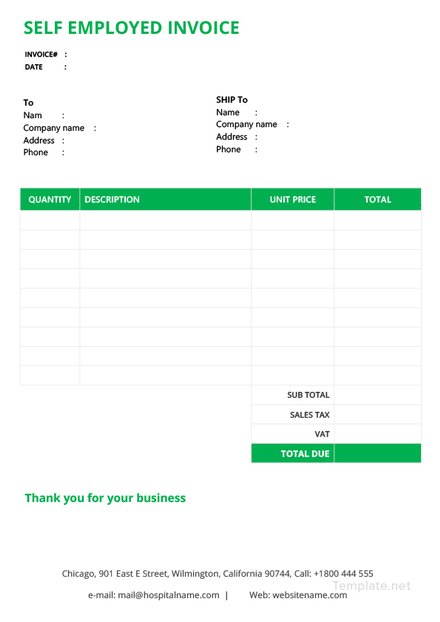

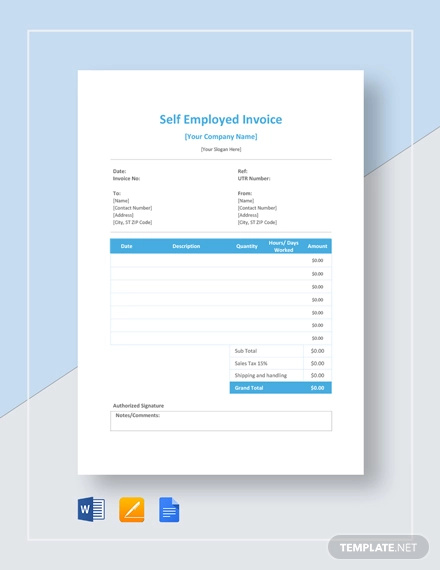

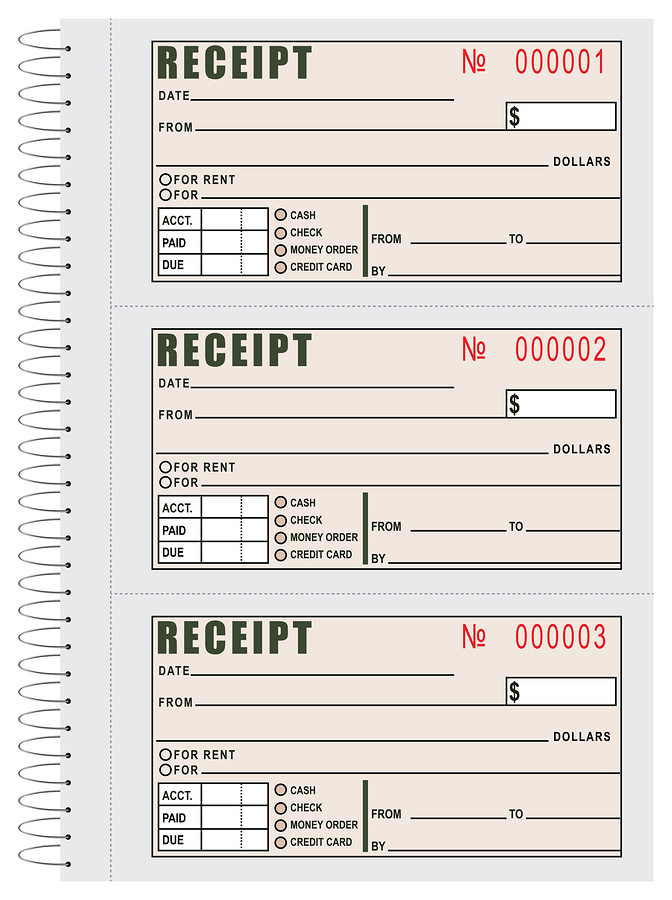

Self employed receipt book. Offer available to new quickbooks self employed customers only. Your books must show your gross income as well as your deductions and credits. Quickbooks self employed keeps your receipts organized in one place and makes them easily searchable. Free self employed invoice template.

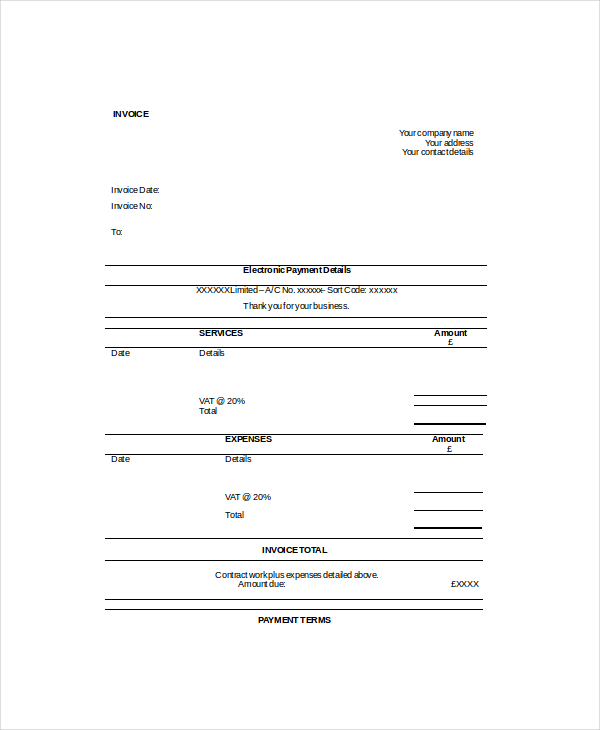

I received a tax credits review letter earlier this week and they wanted details of all work done in the last 3 months i registered as self employed when i first started work i was going to send a copy of the log book i keep hoping this would be sufficient but when i rang they said they really need invoices as well. First thirty 30 days subscription to quickbooks self employed starting from the date of enrollment is free. For most small businesses the business checking account is the main source for entries in the business books. To continue using quickbooks self employed after your 30 day trial youll be asked to present a valid credit card for authorization and youll be charged the then current fee for the services youve selected.

Receive the stated discount off the list price when you license quickbooks self employed directly at the quickbooks canada website. Does your accountant need a specific receipt to help you with your taxes or expense reports. In this short video youll learn how to snap and store receipts on the go with the quickbooks self employed app. After you scan receipts you can use the search bar to find a particular receipt anytime.

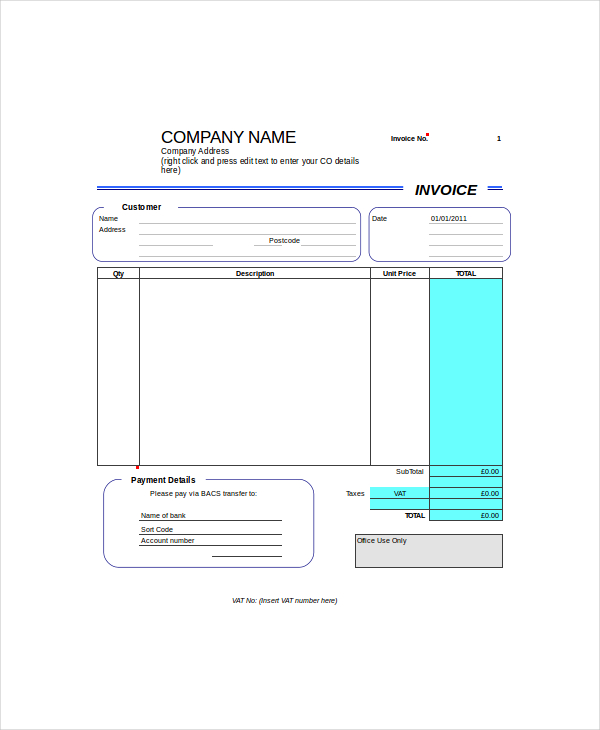

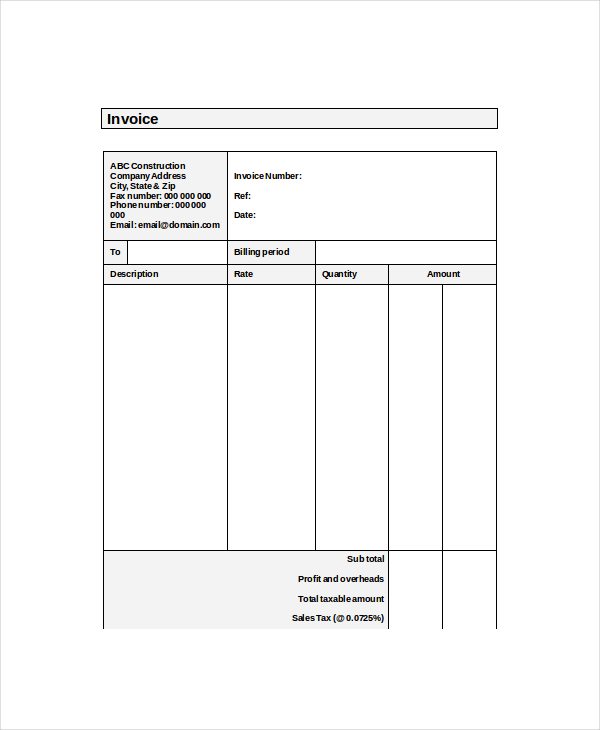

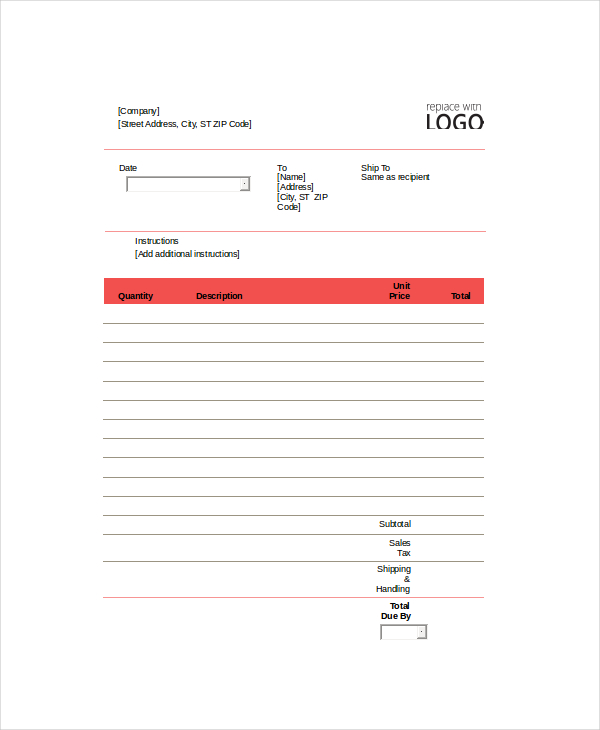

A self employment ledger form maybe a spreadsheet a legal agreement from an accounting software program a self written ledger book or anything that takes note of all self employment cash returns. Save time and money by using the free self employed invoice template from freshbooks for all your invoicing needs. Offer available for a limited time only. Quickbooks self employed customers find on average 4628 in tax savings per year.

Discount is available for the first 3 months of subscription and does not include hstgst. Say goodbye to that shoe box full of receipts. What kind of records should i keep internal revenue service. Users find an average of 7393 in potential mileage deductions per year.

Simply download the template customize with your business details and services and send to your clients.