Sr22 Insurance Certificate

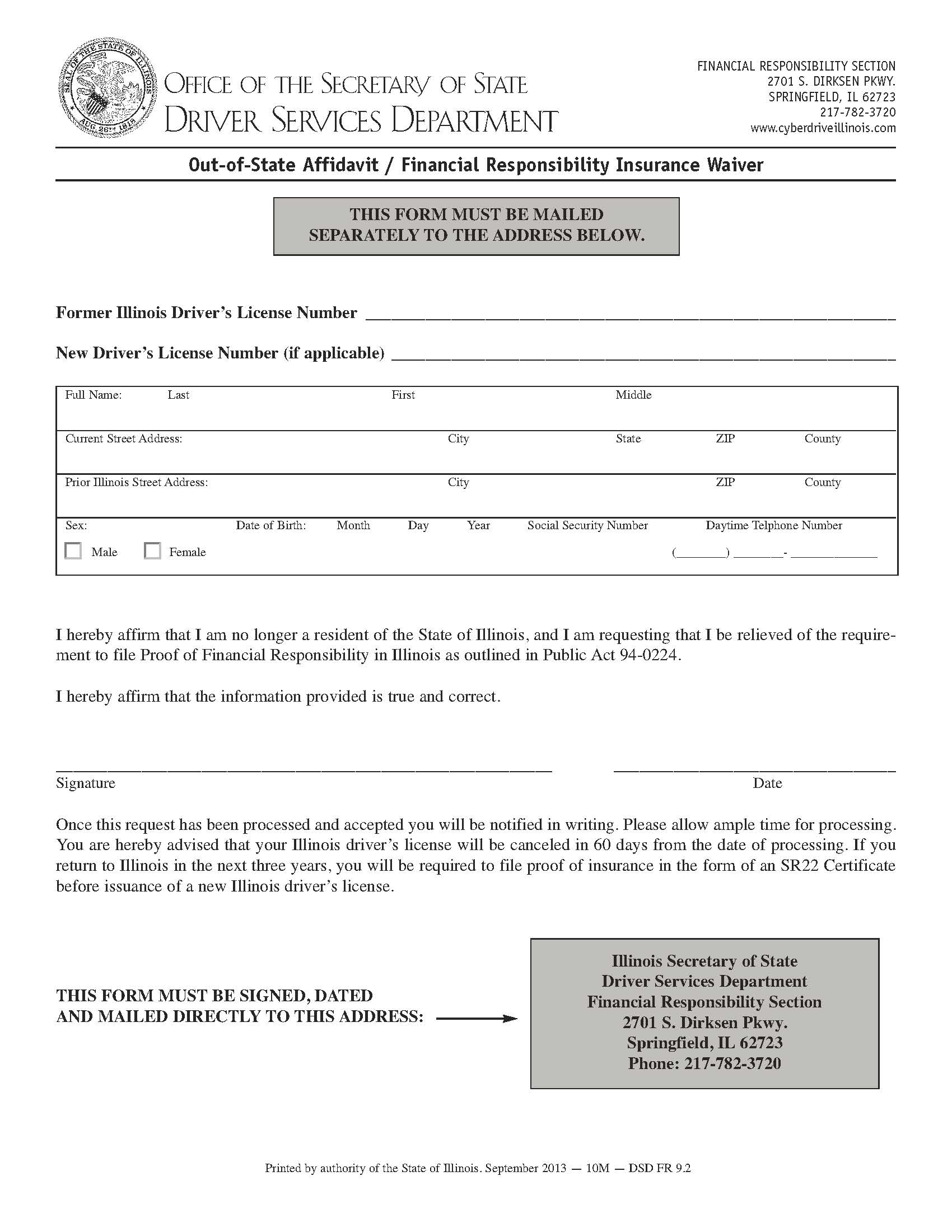

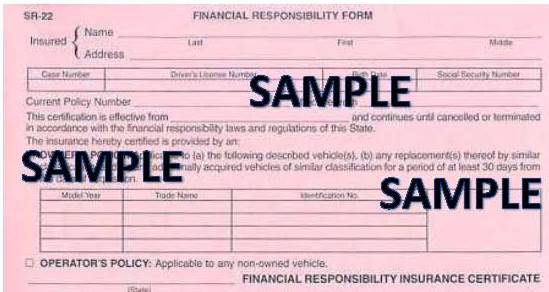

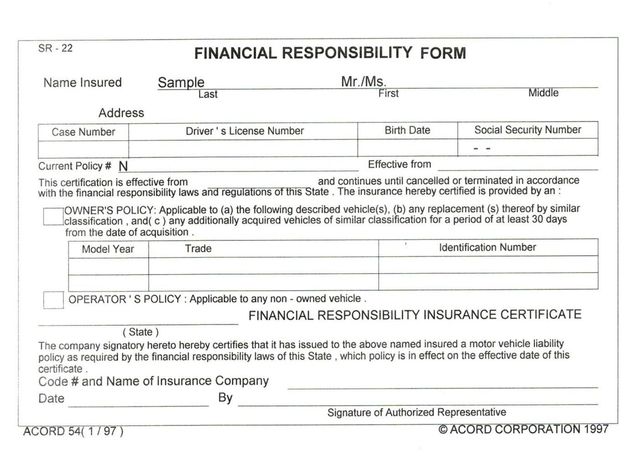

An sr 22 and an fr 44 are both certificate of financial responsibility cfr forms a cfr is a certificate required by the state and provided by your auto insurance company that verifies you have auto insurance liability coverage.

Sr22 insurance certificate. What is new york sr22 insurance. Although determining how to get sr22 insurance in new york can be a complex process understanding what the coverage is and why you may need it can help to demystify the experience. A dmv may require an sr 22 from a driver. People may mistakenly refer to it as sr 22 insurance.

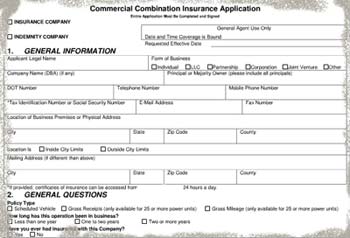

The expense of a non owner sr22 insurance strategy depends on a few components including age sexual orientation postal division conjugal status driving record and fico score. In the united states an sr 22 sometimes referred to as a certificate of insurance or a financial responsibility filing is a vehicle liability insurance document required by most state department of motor vehicles dmv offices for high risk insurance policies. Also known as a certificate of financial responsibility sr 22 bond or sr 22 form an sr 22 isnt a type of insurance but rather an easy to get filing. A financial responsibility insurance certificate sr 22 is required by the texas transportation code chapter 601 to verify that you are maintaining motor vehicle liability insurance.

An sr 22 is a document on file with your state proving you have car insurance that meets the minimum coverages required by law. A sr 22 can be issued by most insurance providers and certifies that you have the minimum liability insurance as required by law. The minimum liability coverage amounts. An insurance provider will automatically notify the department when a sr 22 is cancelled terminated or lapses.

An sr 22 is a form that is filed with your state to show that you are meeting your states minimum auto liability insurance requirements.