Usaa Certificate Rates

Interest bearing accounts such as certificates of deposit cd differ from liquid savings or money market accounts because 1 year cds having a fixed rate maturity period and therefore illiquid tend to provide a higher interest rate of return.

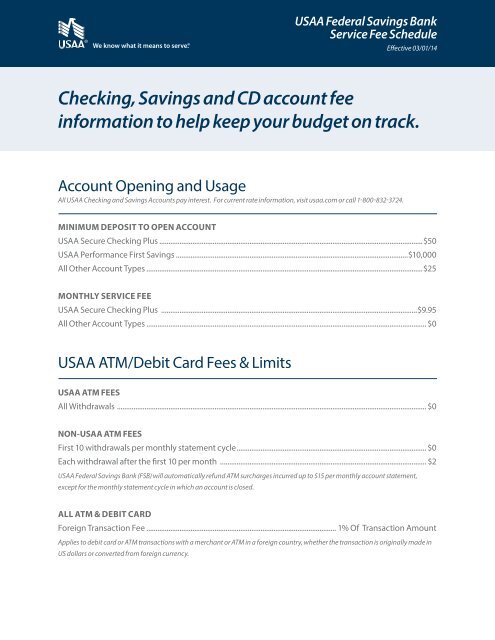

Usaa certificate rates. Usaa stands for the united states automobile association. This requirement is reduced to zero for investors who agree to automatic deposits of 50 or more per month. The rates offered by this bank offer an annual percentage yield that is as high as 355 percent. Above all its important to remember that only usaa members can get its products so if youre not eligible for membership usaa cds arent an option for youusaas cd rates are not as competitive as other institutions products you can see the best cd rates in our monthly roundup.

While i appreciate that the rate is not stellar at least its finally competitive. There is no monthly fee as long as a 1000 minimum balance or 50 recurring deposit is maintained. Usaa members can check out the full panoply of new cd rates on usaas website but imho the best on offer is the super jumbo 175000 at five years at 314 apy. The usaa money market fund requires an initial investment of 1000.

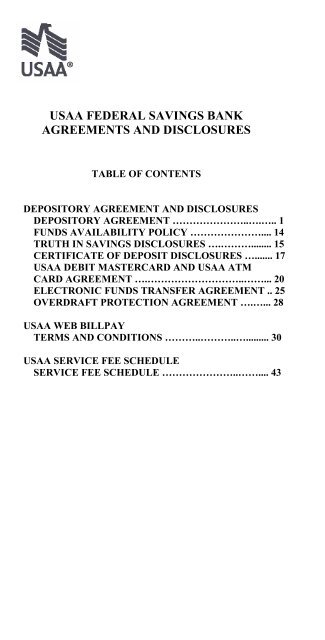

Usaa variable rate cd usaas variable rate cd offers customers the unique opportunity to make additional deposits through the accounts term. While the 1000 minimum deposit requirement is lower than some other banks that offer higher apys on their cds you can get a better cd rate on accounts with deposit requirements as low as 500. All of the certificates of deposit offered by the usaa bank are insured by the federal deposit insurance corporation fdic up to the amount of 250000.