501c3 Receipt Template

Nonprofits have certain requirements to follow including providing donors with a donation receipt often called an acknowledgment letter.

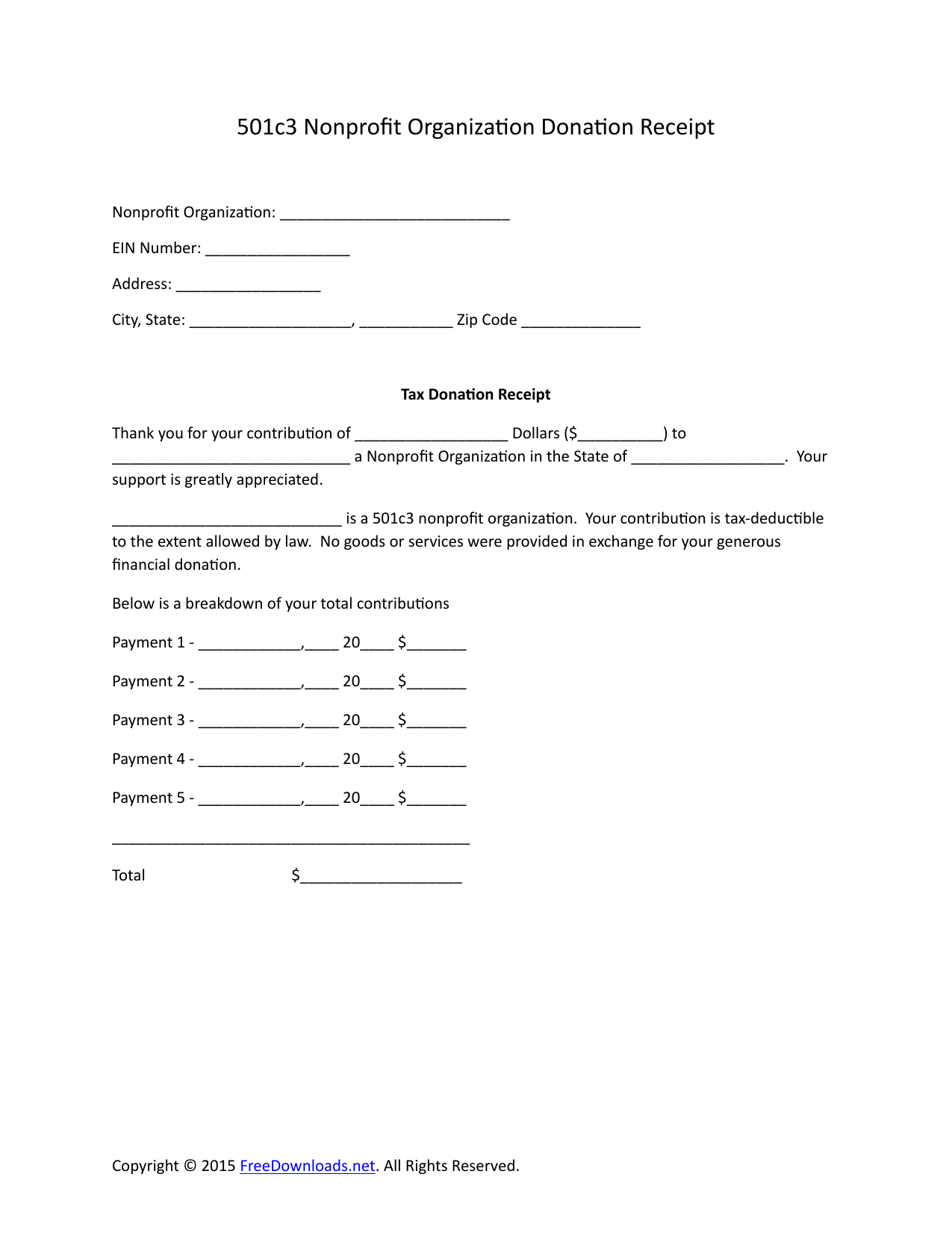

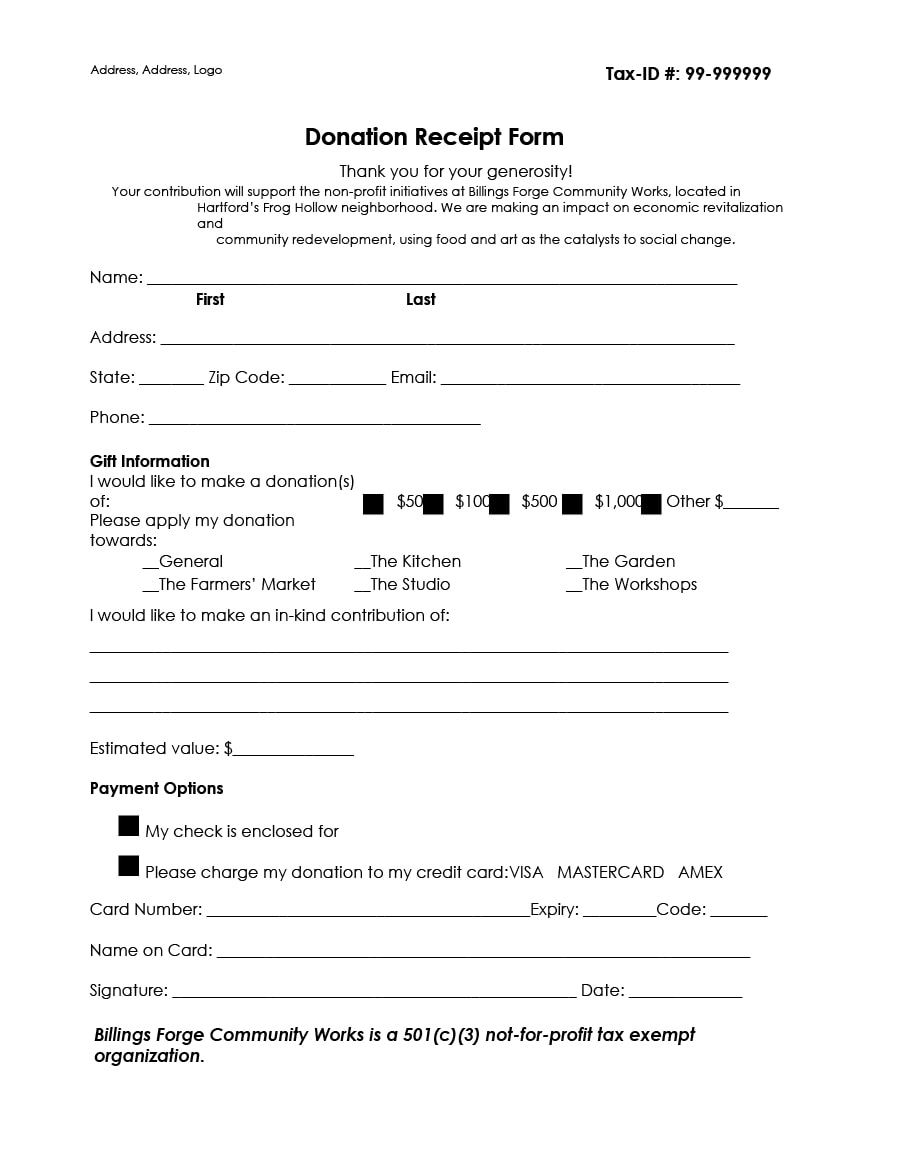

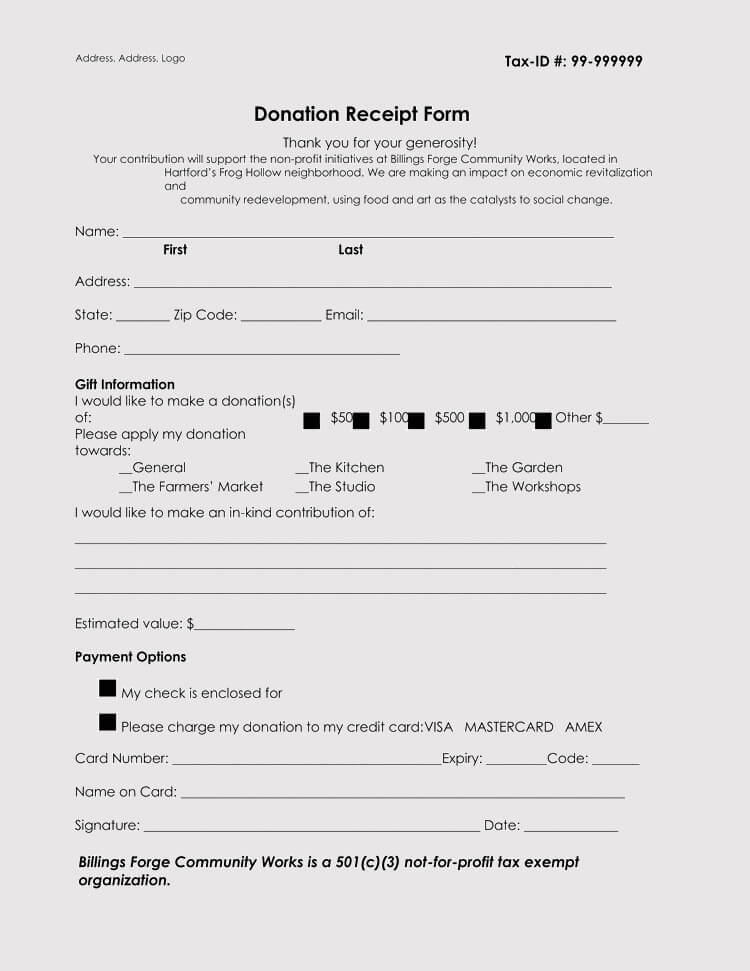

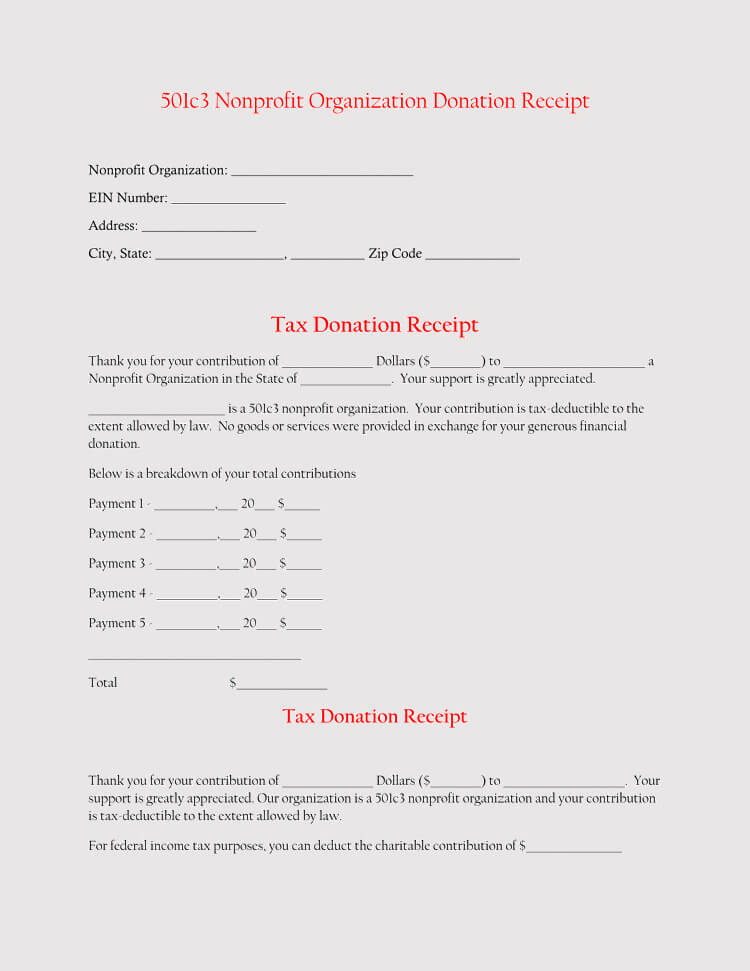

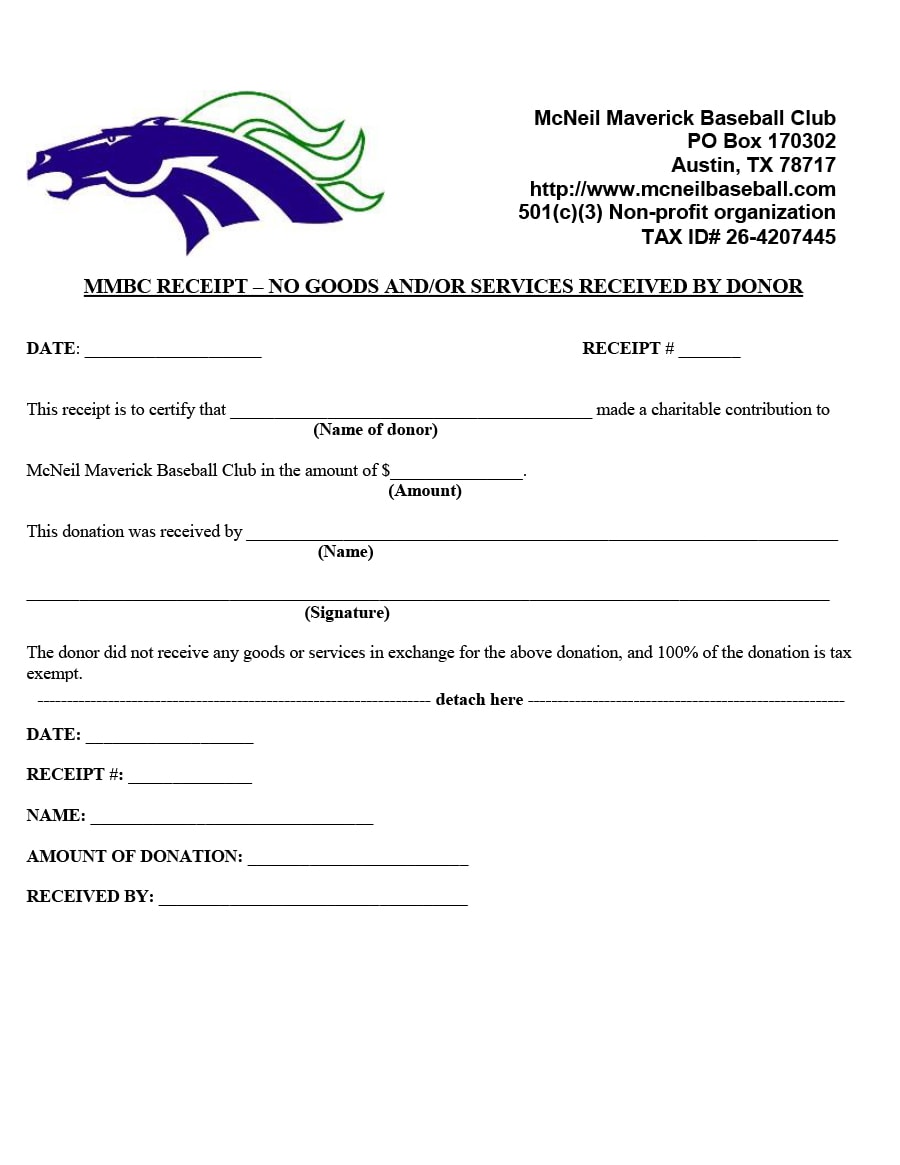

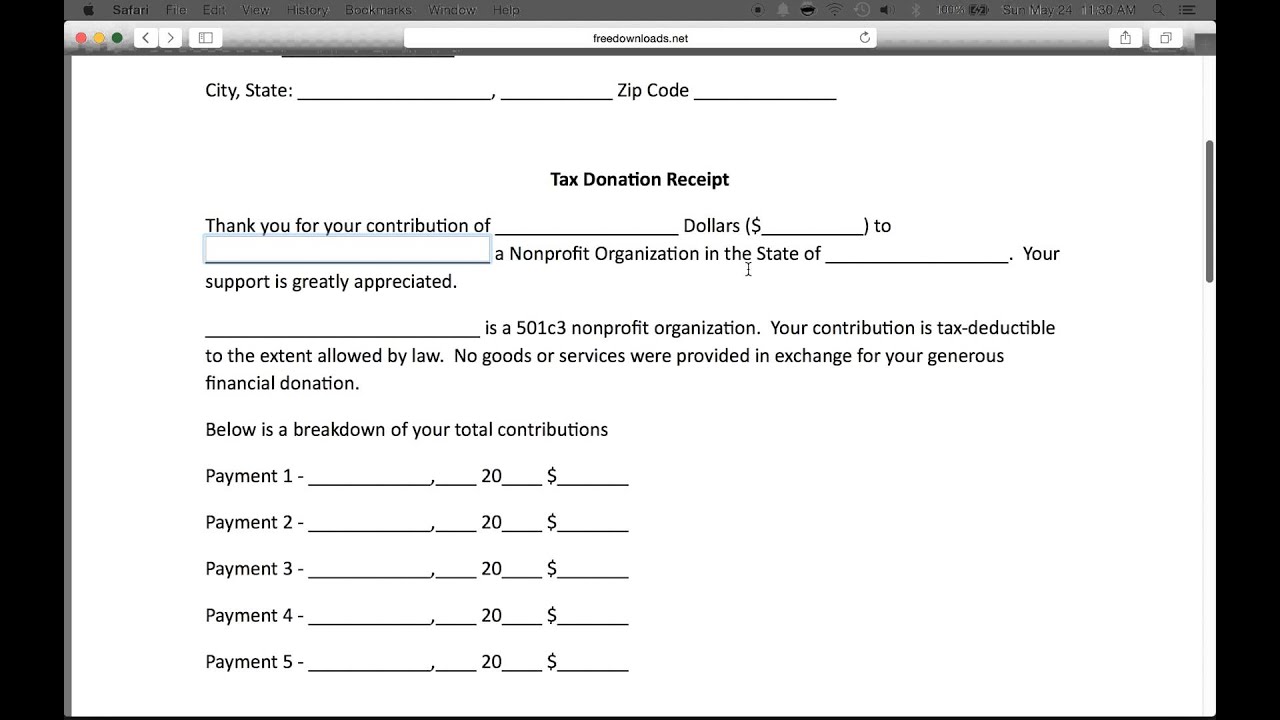

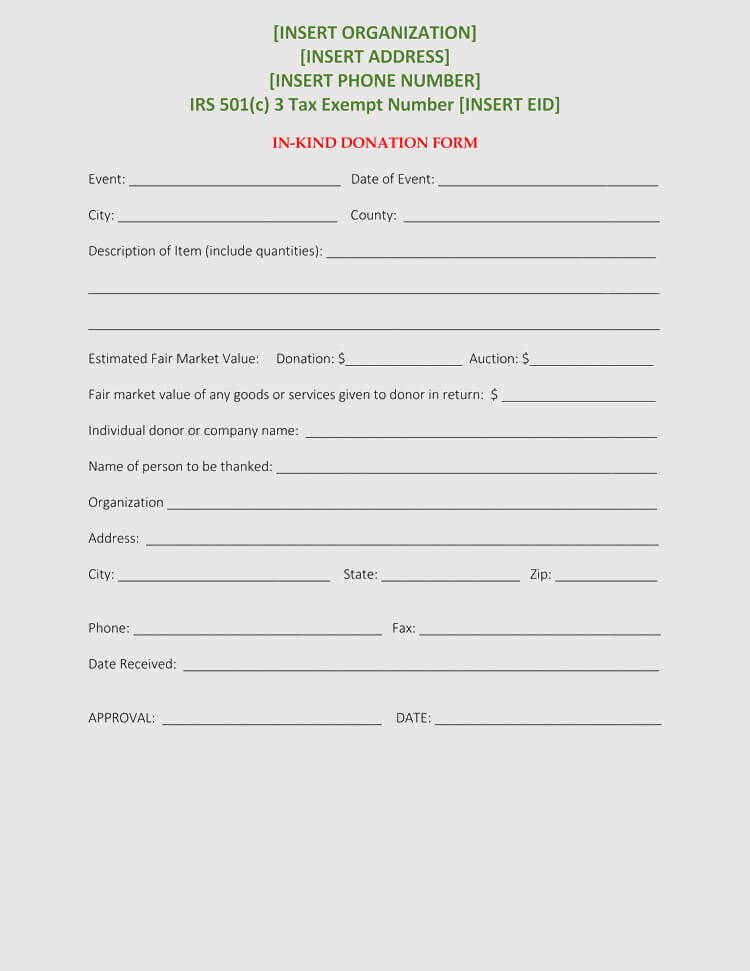

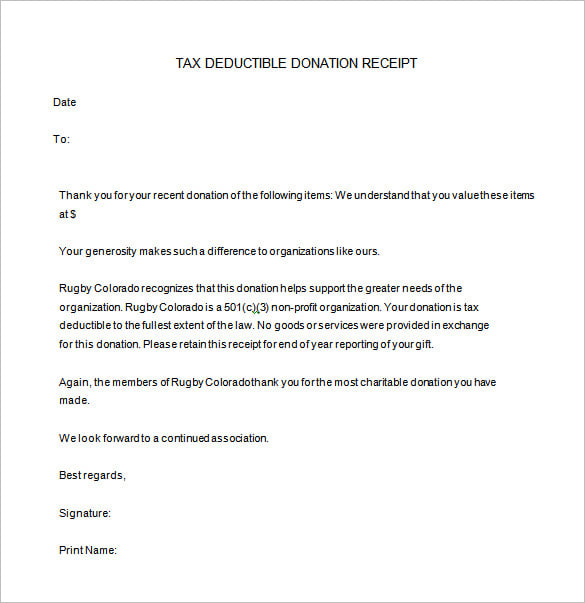

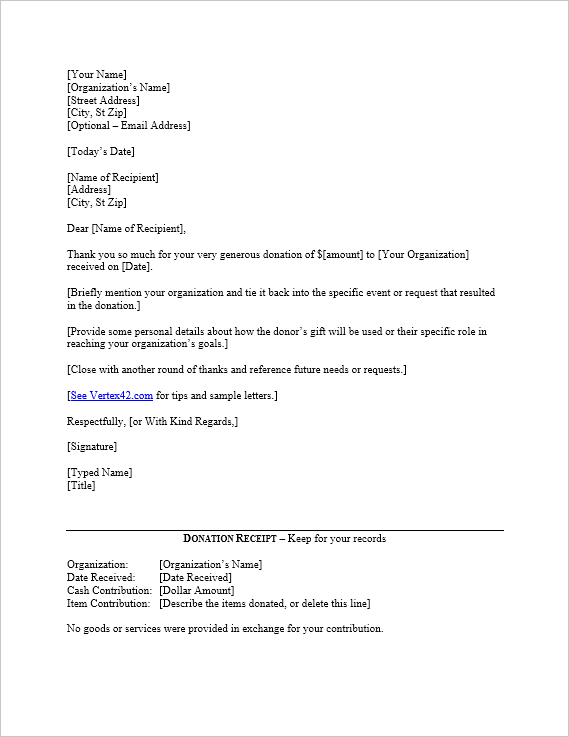

501c3 receipt template. Using a donation receipt template. The donation receipt template is very easy to use. The donation receipt letter for tax purposes also known as form 501c3 is a document to be given to a contributor of a non profit charity that is recognized by the internal revenue service. This nonprofit donation receipt template helps you create donation receipts quickly and easily.

How to create a 501c3 compliant receipt using donorbox. With this nonprofit donation receipt template you can. Simply select the template desired. Also make a copy and file all the donation receipts which you have given out to keep track of all the donations and for tax purposes as well.

We have prepared examples of tax donation receipts that a 501c3 organization should provide to its donors. What is a donor acknowledgment letter. Add the organizations logo and name. The receipt shows that a charitable contribution was made to your organization by the individual or business.

Templates 501c3 tax deductible receipts pdf version 501c3 tax deductible receipts word version these are examples of tax donation receipts that a 501c3 organization should provide to its donors. Learn what needs to be included in this letter. Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. The templates that we provide are basic ones.

The templates were designed with word and excel which makes the templates easy to customize with your own organizational details logo and more. A donor acknowledgment letter is more than just a thank you letter. The 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. The receipt shows that a charitable contribution was made to your organization by the individual or business.

It is a microsoft word document so that you can easily customize it to make it work based on your needs. Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction.