Sales Exemption Certificate

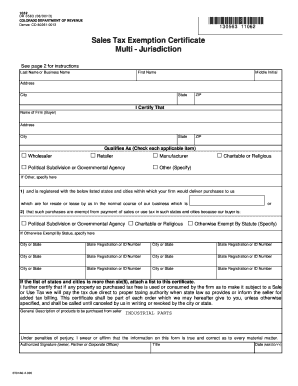

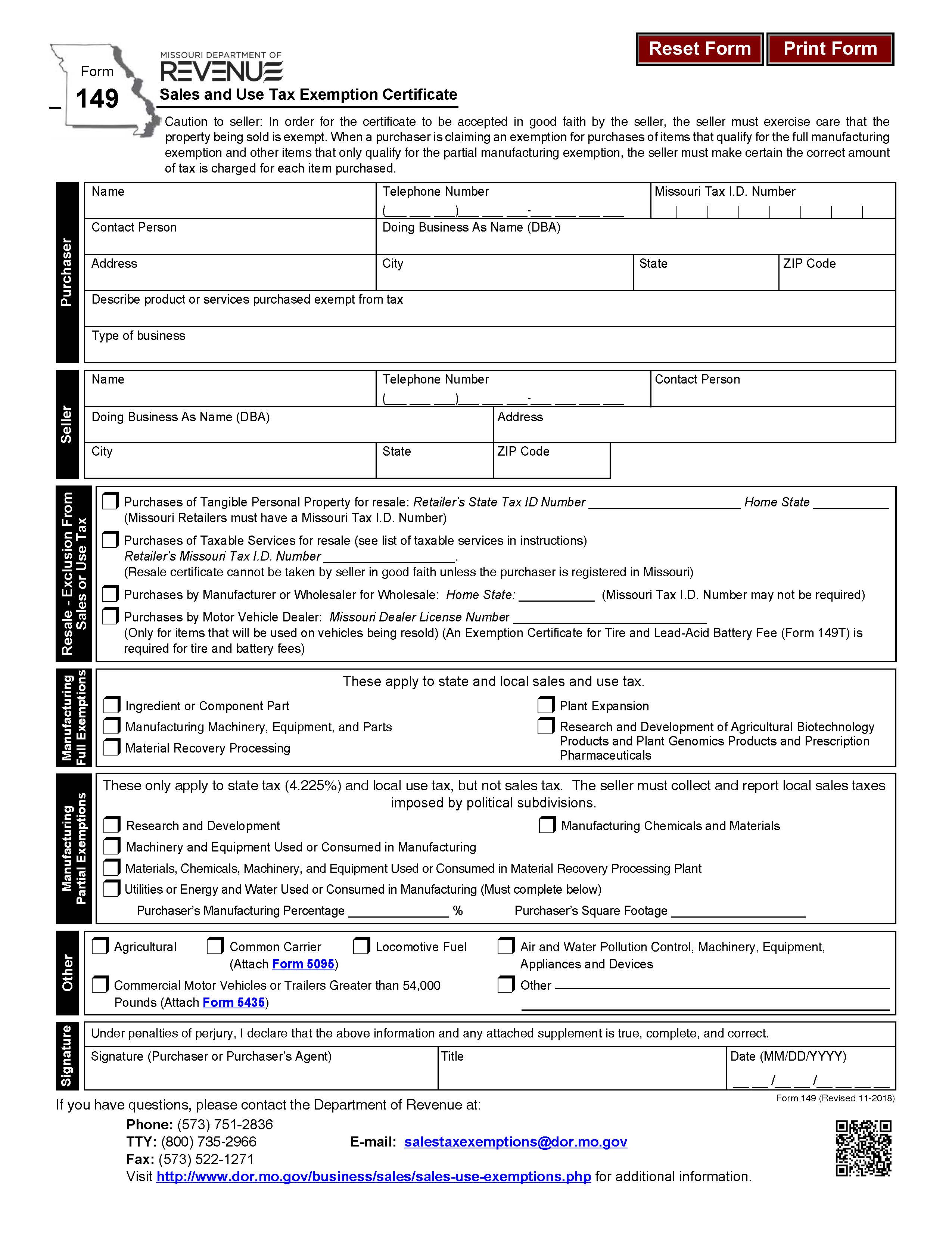

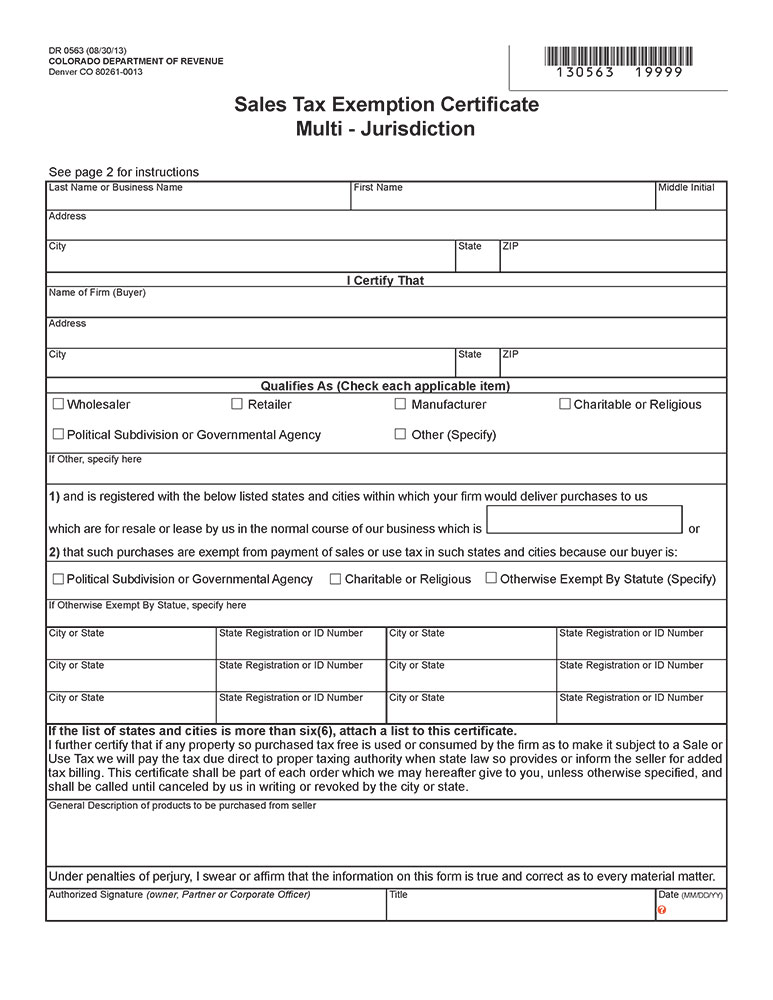

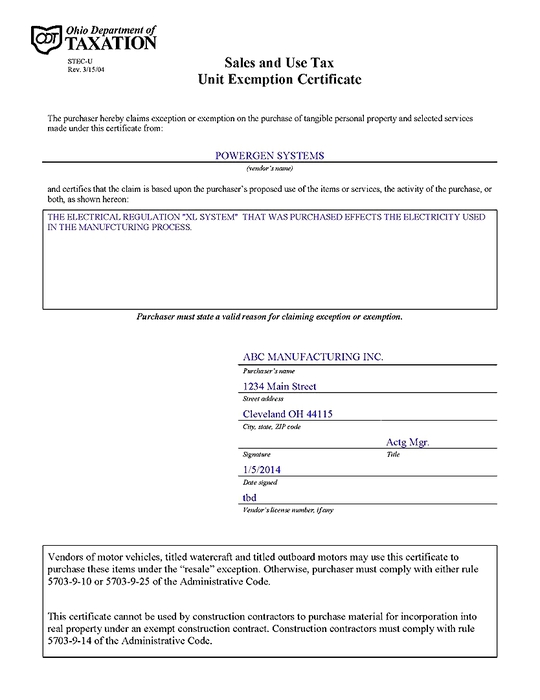

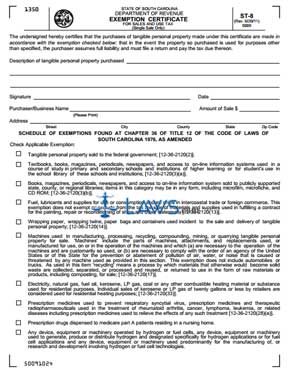

Sales tax exemption certificates enable a purchaser to make tax free purchases that would normally be subject to sales tax.

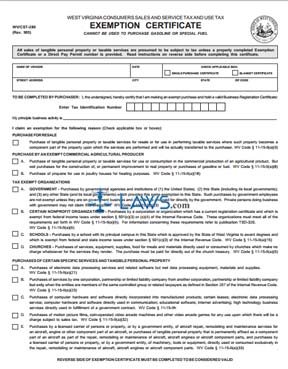

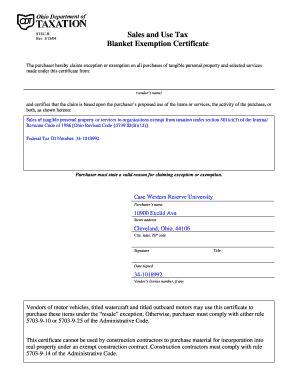

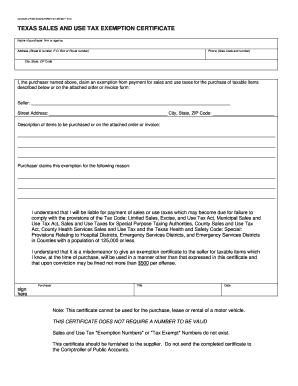

Sales exemption certificate. Form st 120 resale certificate is a sales tax exemption certificate. Sales tax exemption certificates for governmental entities florida law grants governmental entities including states counties municipalities and political subdivisions eg school districts or municipal libraries an exemption from florida sales and use tax. There are two main types of exemption certificates. This certificate does not require a number to be valid.

Agencies elected officials state jobs quick links. Sales tax by using an exemption certificate for items or services that will be used for purposes other than those being claimed you may be fined 100 under minnesota law for each transaction for which the certificate is used. This certificate is only for use by a purchaser who. This certificate does not require a number to be valid.

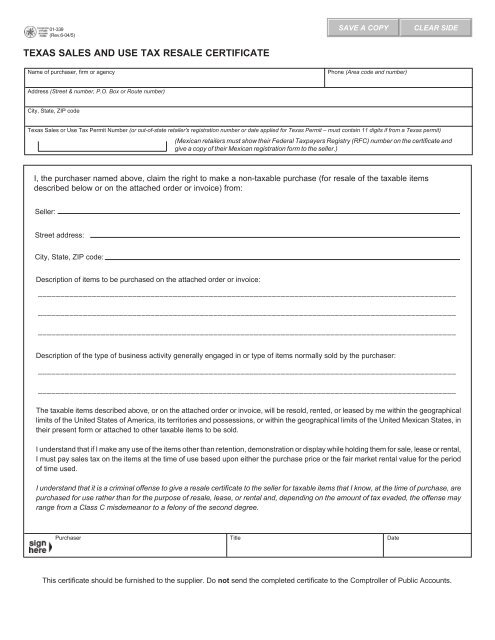

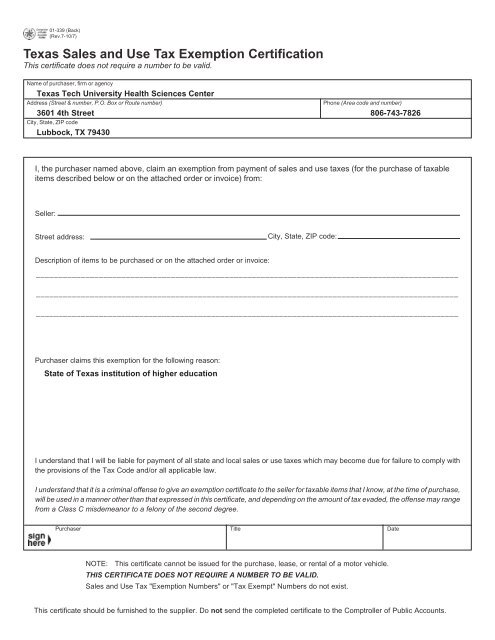

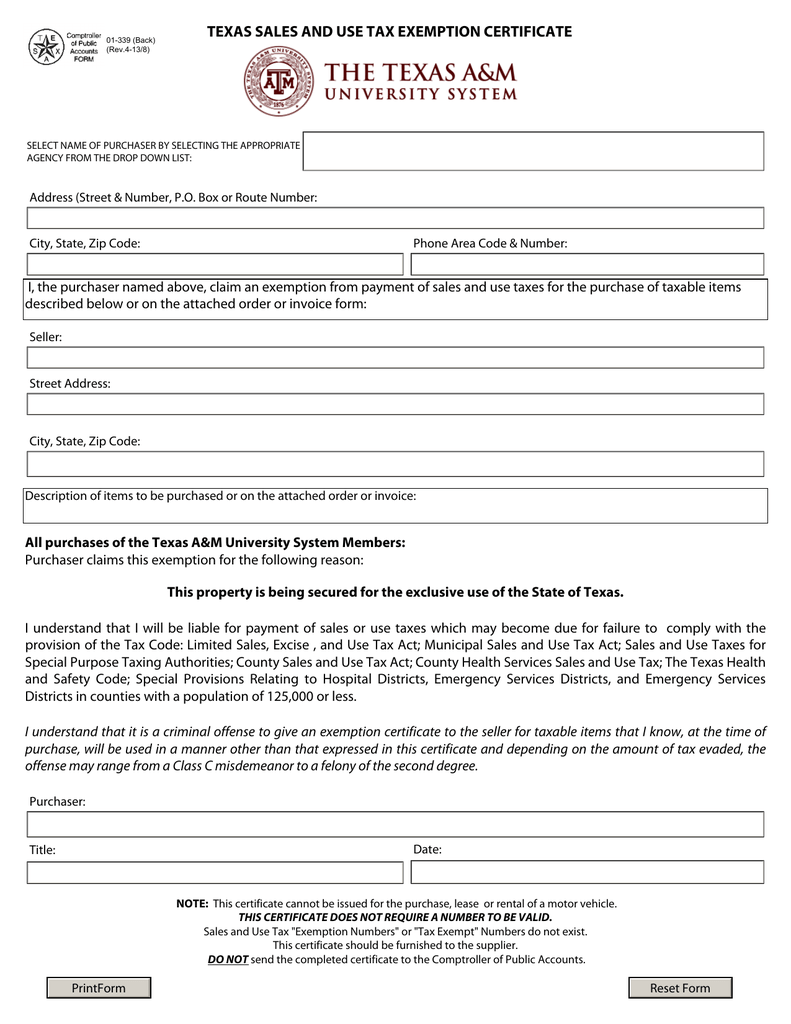

St 5 certificate of exemption st 5 certificate of exemption. How can we help. I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable. Box or route number phone area code and number city state zip code.

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Texas sales and use tax exemption certification. Es and use tax exemption numbers or tax exempt numbers do not exist. The purchaser fills out the certificate and gives it to the seller.

This certificate cannot be issued for the purchase lease or rental of a motor vehicle. In other words sales tax exemption certificates are your proof that you can buy an item tax free. A is registered as a new york state sales tax vendor and has a valid certificate of authority issued by the tax department and is making purchases of tangible personal property other than motor fuel or. Name of purchaser firm or agency address street number po.

Sales and use tax exemption for a motor vehicle purchased by a nonresident of connecticut see cert 139 for purchase of vessels by nonresidents. This certificate should be furnished to the supplier. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax. The seller must retain this certificate as proof that exemption has been properly claimed.