W4 Forms 2019 Printable

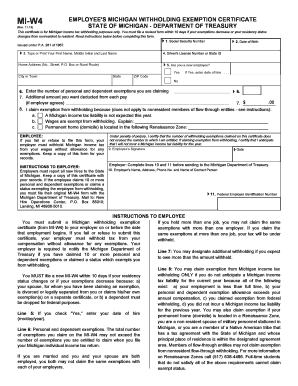

Employees withholding allowance certificate it 2104 e fill in 2020 instructions on form.

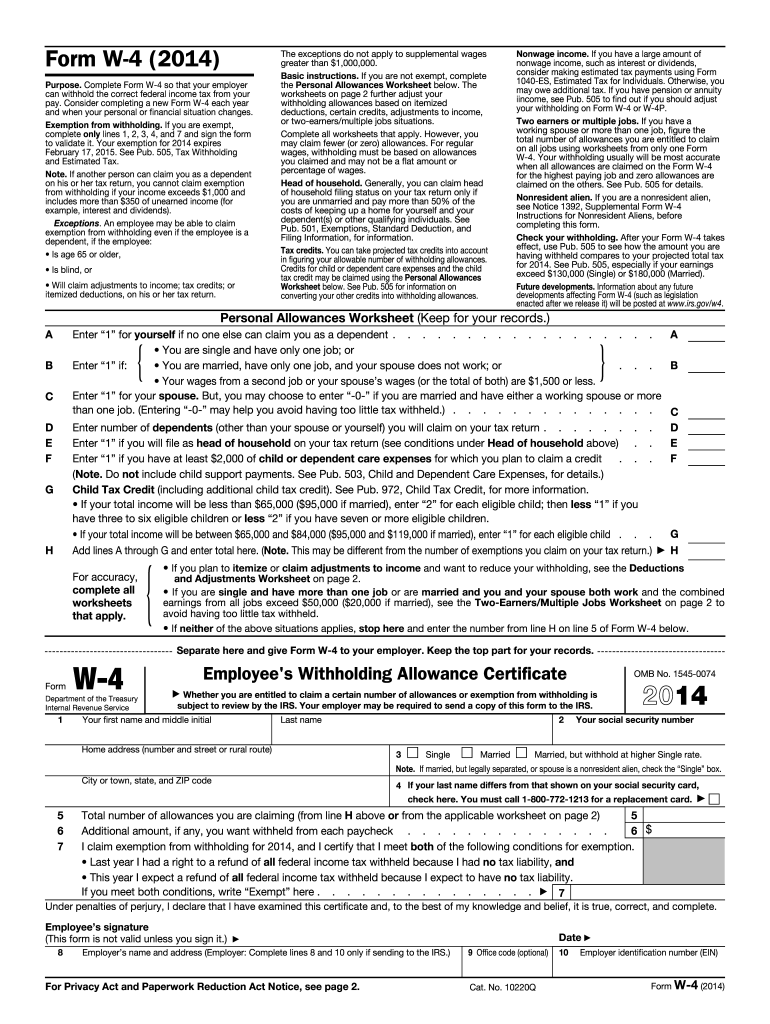

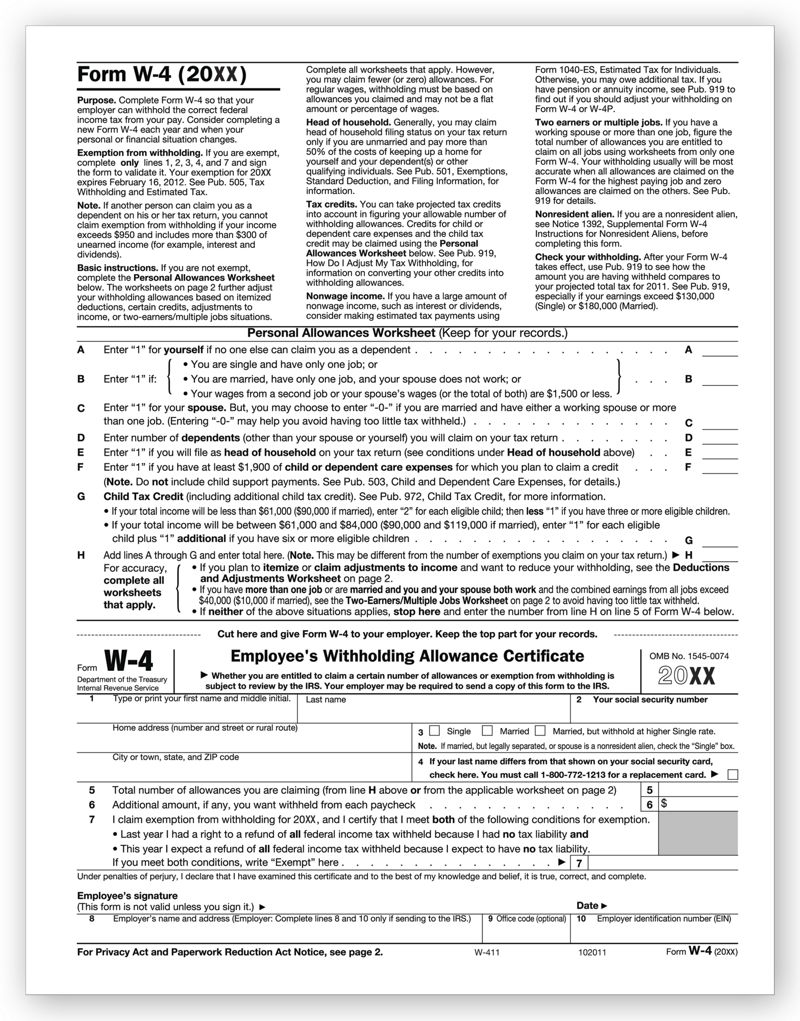

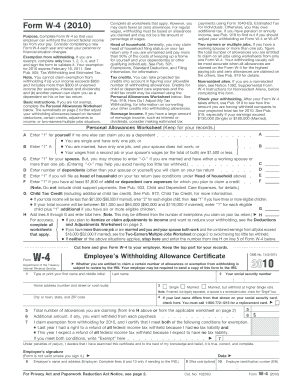

W4 forms 2019 printable. Use this form to ask payers to withhold federal income tax from certain government payments. Form il w 4 for the highest paying job and claim zero on all of your other il w 4 forms. Print or instantly send your documents. Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file.

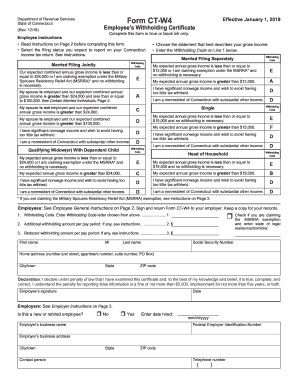

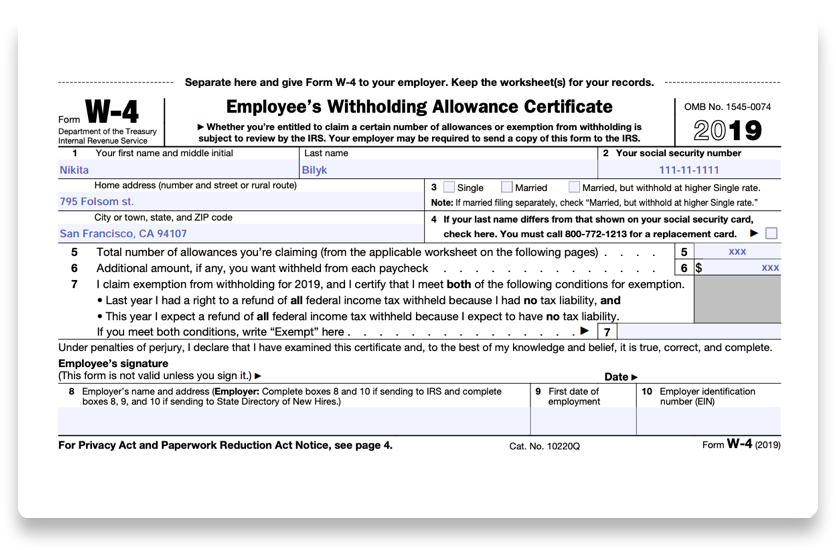

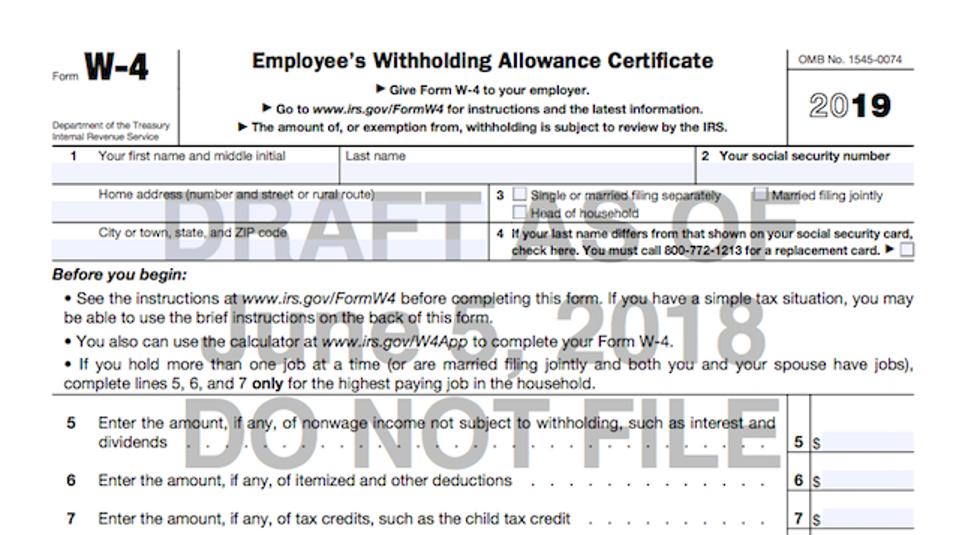

Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Form number instructions form title. Form g4 is to be completed. Form w 4 2020 employees withholding certificate.

Certificate of exemption from withholding it 2104 ind fill in instructions on form. Withholding tax forms 20182019. 2019 the president signed legislation to amend the federal food drug and cosmetic act and raise the federal minimum age of sale of tobacco products from 18 to 21 years. Get printable w 4 form to file in 2019.

Enter a term in the find box. 2 income includes all of your wages and other income including income earned by a spouse if you are filing a joint return. Form g4 is to be completed and submitted to your employer in order to. Select a category column heading in the drop down.

It 2104 fill in 2020 instructions on form. Create and fill out pdf blanks online. Form w 4p 2019 page. Form w 4 2019 page.

We offer detailed instructions for the correct federal income tax withholdings. Information about form w 4v voluntary withholding request including recent updates related forms and instructions on how to file. Form g 4 employee withholding form g 4 employee withholding. Forms and publications pdf instructions.

2 because your tax situation may change from year to year you may want to refigure your withholding each year. Line 16 on your 2019 form 1040 or 1040 sr is zero or less than the sum of lines 18a 18b and 18c or 2 you were not required to file a return because your income was below the filing threshold for your correct filing status. You can easily sign edit and save them.